Real-world budget breakdown tailored for DINK couples in their 30s, showing exactly how to allocate income, save smart, and plan for the future—without kids in the mix.

Let’s face it—budget planning for DINK couples in their 30s is a whole different game with two paychecks and zero diaper duty. That’s why more couples are proudly living the DINK life: Dual Income, No Kids. This fast-growing crew isn’t just challenging traditions—they’re flipping the script on how wealth, freedom, and early retirement are done. With no little ones tugging at their wallets, DINK couples are primed to stack cash, explore the world, and design a future on their own terms.

But here’s the thing—most budgeting advice out there? Snooze-worthy and way too vague. That’s where we come in. This guide dives into real numbers, using a $250,000 annual take-home income to show exactly how your money can work harder, grow faster, and still leave room for that last-minute trip to Bali. And if travel is your love language, don’t miss our DINK travel guide packed with smart tips to explore more while spending less.

Why DINK Couples Have a Financial Advantage

According to the United States Census Bureau, 43% of American households were childless as of 2022, a 7% rise from the previous decade. As more Millennials and Gen Z adults defer or reject traditional parenting timelines, DINK households are emerging as financial power players.

Unlike parents who allocate large chunks of income to childcare, schooling, and family-related expenses, DINK couples can direct a greater portion of their income toward savings, investments, lifestyle upgrades, and personal growth.

Budget Breakdown for a DINK Couple Earning $250,000 Annually

Let’s look at a realistic, smart budget for a couple earning $250,000 per year. Change the figures based on your income.

1. Essentials Budget (Needs) – To Be Followed Every Month

| Category | Recommended % | Annual Amount (USD) | Monthly Avg. | Notes |

|---|---|---|---|---|

| Essentials (Needs) | 40% | $100,000 | $8,333 | Housing, food, transport, insurance |

| • Housing (Rent/Mortgage) | 25% | $62,500 | $5,208 | Apartment or mortgage payments |

| • Groceries & Household Items | 5% | $12,500 | $1,042 | Groceries, cleaning, toiletries |

| • Transportation | 5% | $12,500 | $1,042 | Car, gas, rideshare, maintenance |

| • Insurance (Health, Dental, Life) | 5% | $12,500 | $1,042 | Basic health and life coverage |

Assumptions: Based on $250,000/year take-home income. Assumes urban/suburban living, mid-tier insurance plans, and no dependents.

2. Wants Budget (Lifestyle) – To Be Followed Every Month

| Category | Recommended % | Annual Amount (USD) | Monthly Avg. | Notes |

| Wants (Lifestyle) | 30% | $75,000 | $6,250 | Discretionary spending |

| • Dining Out & Takeout | 5% | $12,500 | $1,042 | Social meals, casual dining |

| • Travel & Vacations | 10% | $25,000 | $2,083 | 2-3 trips per year |

| • Entertainment & Hobbies | 5% | $12,500 | $1,042 | Netflix, concerts, memberships |

| • Shopping (Tech, Apparel) | 5% | $12,500 | $1,042 | Non-essential purchases |

| • Wellness & Fitness | 5% | $12,500 | $1,042 | Gym, therapy, skincare |

Assumptions: Based on a lifestyle that includes annual travel, regular outings, and modest luxury spending.

3. Emergency Fund Strategy for DINKs – To Be Followed Once Until the Amount is Accumulated

Accumulate this amount and keep it in a high-yield savings account before starting with the 4th part i.e. Savings & Investment Budget. The idea is to have a corpus for the times like job loss or health emergency.

| Goal | Amount (USD) | Purpose |

| 6-Month Essentials Buffer | $50,000 | For job loss or emergencies |

| Health Crisis Fund | $10,000 | Unexpected medical costs |

| Flexibility Fund | $10,000 | Freelance switch, sabbatical |

| Total Target Emergency | $70,000 |

Assumptions: Emergency reserves calculated based on essential expenses; assumes moderate risk tolerance and no dependents.

4. Savings & Investment Budget -To Be Followed Every Month After Completing Step 3

| Category | Recommended % | Annual Amount (USD) | Monthly Avg. | Notes |

| Savings & Investments | 30% | $75,000 | $6,250 | Wealth-building tools |

| • Retirement Contributions | 10% | $25,000 | $2,083 | 401(k), Roth IRA |

| • Index Funds | 10% | $25,000 | $2,083 | ETFs, stocks, mutual funds |

| • Real Estate | 3% | $7,500 | $625 | Rental income or passion project |

| • Donations/Charity | 2% | $5,000 | $417 | Philanthropy or cause giving |

| • Flexible Cash Reserves | 5% | $12,500 | $1,042 | For short-term needs or pivot fund |

Assumptions: Investment returns assumed at 7% annually; emergency savings goal aligned with essential costs; all contributions pre-tax or tax-advantaged when applicable.

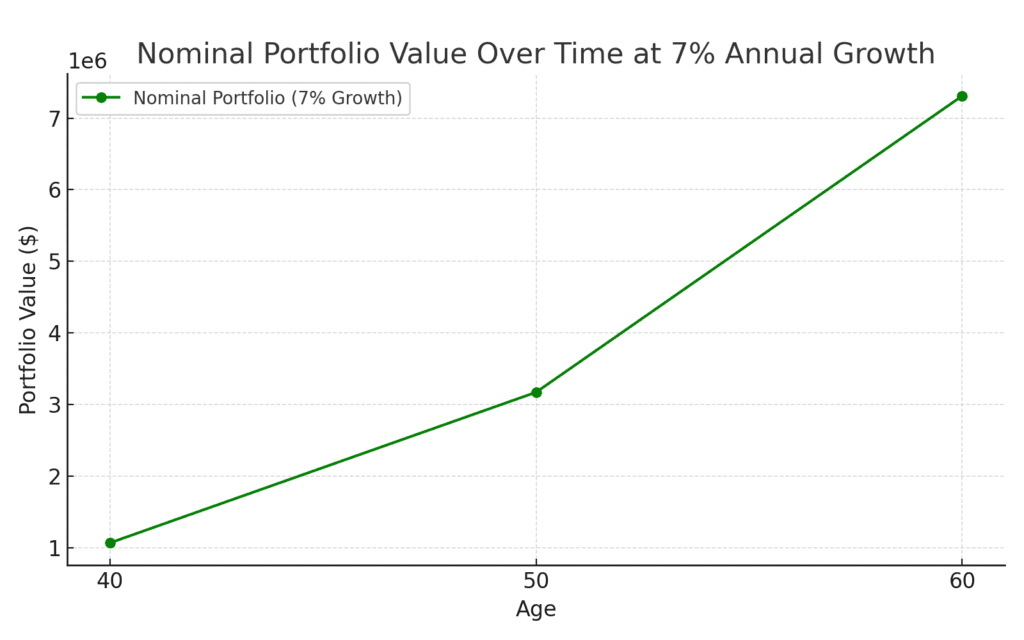

DINK Investment Growth Over Time

If a DINK couple invests $75,000 annually (30% of income) starting at age 30 and earns a 7% return, this is how their wealth would grow.

Compound Growth Table

| Age | Years of Investing | Total Invested | Estimated Portfolio (Nominal) |

| 40 | 10 | $750,000 | $1,069,073 |

| 50 | 20 | $1,500,000 | $3,172,102 |

| 60 | 30 | $2,250,000 | $7,309,079 |

Assumptions: 7% nominal return compounded annually; investments made evenly throughout each year. Not adjusted for inflation.

Final Thoughts

DINK couples are in a powerful financial position to reach their goals faster than the average household. By budgeting wisely, automating savings, and prioritizing smart investments, you can enjoy both the present and a financially free future.

If you’re a DINK couple looking to maximize your income, consider our budget planning for DINK couples in their 30s your starting blueprint. And remember: your money should work as hard as you do—without diapers in the equation.